SOVEREIGN ROYAL HOUSE OF BRITISH ISLES & BRITISH EMPIRE !!!

- TWLF IGO WORLD HQ IRELAND

- Oct 31, 2022

- 14 min read

Updated: Mar 11, 2025

*ROYAL COAT OF ARMS OF ~ U.K. / UNITED KINGDOM :

Royal Coat Of Arms Of The United Kingdom, drum Stick, Bronze, crest, Coat of arms, lion, brass, GOLD, animal, Metal, clipart.

*PORTRAIT OF EMPEROR WILLIAM THE CONQUEROR I : [ORIGINALLLY FROM ~

'' ROYAL HOUSE OF NORMANDY '', FRANCE -- WHO WAS ALSO THE RULER /

KING OF ~ U.K. (UNITED KINGDOM) AND IRELAND]

*NATIONAL COAT OF ARMS OF ~ U.K. / UNITED KINGDOM :

Elkin, mantle And Pavilion, mantling, mantel, national Coat Of Arms, royal Coat Of Arms Of The United Kingdom, Elsa, heraldry, Frozen, crest, clipart.

Mantle And Pavilion, Peerage Of France, Orn, Mantling, Coronet, Royal Coat Of Arms Of The United Kingdom, Blazon, Duke, Heraldry, Crest, Clipart.

*Coats of Arms Of The United Kingdom (U.K.) To Be Classified :

KINGDOM OF BRITISH ISLES ~ THIS PARTICULAR ROYAL ADMINISTRATION OF THE EMPEROR WILL REPRESENT SOVEREIGN ROYAL ADMINISTRATION OF UNITED KINGDOM & BRITISH ISLES AND BRITISH EMPIRE . THE EMPEROR REPRESENTING HIS ANCESTOR EMPEROR WILLIAM THE CONQUEROR 1st WITHIN UNITED KINGDOM OF GREAT BRITAIN AND IRELAND & BRITISH ISLES & BRITISH EMPIRE . THIS ROYAL ADMINISTRATION OF KING OF KINGS WILL BE FULLY FUNCTIONAL FROM UK.

*ABOUT UNITED KINGDOM OF GREAT BRITAIN AND IRELAND :

*ABOUT BRITISH ISLES :

*ABOUT BRITISH EMPIRE:

*APART FROM THE HEREDITARY RIGHTS THE EMPEROR (KING OF KINGS) WAS PREVIOUSLY ALSO EMPOWERED WITH NOBILITY TITLES BY OTHER SOVEREIGNS

AS THE :

1) KING OF ISLE OF ANGLESEY, WALES, UK ;

2) EMPEROR OF KINGDOM OF IRELAND (THAT IS REPUBLIC OF IRELAND WHICH IS PART OF EUROPEAN UNION / EU AND NORTHERN IRELAND WHICH IS PART OF UNITED KINGDOM/UK) ;

3) KING OF TUSCANY, ITALY, EU ;

*FULL NAME OF THE EMPEROR WITH HIS TITLES AND QUALIFICATIONS :

HIM EMPEROR KING ARCHDUKE LORD MIP H.E. VVIP MVP CHANCELLOR

SENIOR PROF. DR. INTERNATIONAL JUDGE AND PROVOST MARSHALL GENERAL

SIR CHOWDHURY, MOSHARAF HOSSAIN ~ CERTIFIED ~ CEO, CTO, CFO, CWO,

UCIB, CTT, ECONOMIST, LEAD AUDITOR, CIO, ChPP, CIP, CFP, CEMS, DGG, DLC,

DCM, DIDP, HRM, BSc Engg CS, BSc GE, M.Sc. CS , MSc LS, CURM , ARCHITECT, CONSULTANT, BBA, Mini - MBA, MBA , JUDICIAL ARBITRATOR, LLM, PDPM,

PDSM, PDREA, PGD ~ AI, PGD ~ PSCM, Ph.D. , Ed.D., Psy.D, DSJ, DOE, DWM,

DLM, DLE, DMETA, DTh, DBA, D.Litt.

*BRITISH COLONIES :

*LONDON VIRGINIA COMPANY: [ROYAL FAMILY ASSET]

*EAST INDIA COMPANY : [ROYAL FAMILY ASSET]

*HUDSON'S BAY COMPANY : [ROYAL FAMILY ASSET]

*FOR MORE DETAILS ABOUT OUR MONARCHY & ROYAL ADMINS WORLDWIDE & GENERAL INFO ABOUT THE EMPEROR VISIT THE SHARED WEBLINKS BELOW :

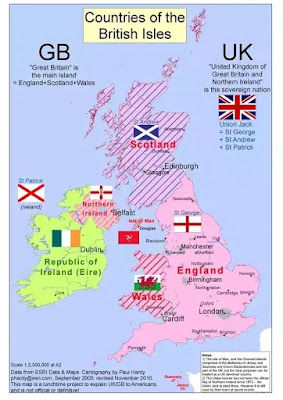

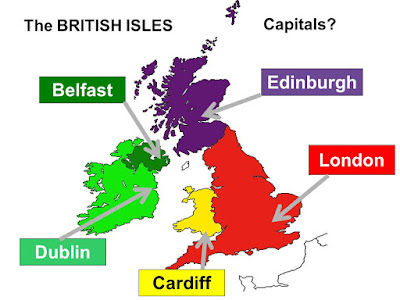

*DIFFERENT HISTORICAL MAPS OF BRITISH ISLES :

*MAP IMAGE NUMBER~ 1 :

*MAP IMAGE NUMBER ~ 2 :

*MAP IMAGE NUMBER ~ 3 :

*MAP IMAGE NUMBER ~ 4 :

*MAP IMAGE NUMBER ~ 5 :

*MAP IMAGE NUMBER ~ 6 :

*MAP IMAGE NUMBER ~ 7 :

*FOR ADDITIONAL MAP INFO OF ~ '' BRITISH ISLES '' ~ VISIT THE SHARED WEBLINKS BELOW :

*COMMONWEALTH PARLIAMENT DETAILS :

COMMONWEALTH PARLIAMENT WILL OPERATE WITH JOINT ADMINISTRATIVE COLLABORATION OF EMPERORS ROYAL ADMINISTRATIONS BASED IN UK AND IRELAND.

* FEDERAL GOVERNMENT OF COMMONWEALTH / FEDERATION OF COMMONWEALTH OF NATIONS :

FEDERAL GOVERNMENT OF COMMONWEALTH KING OF KINGS AND HIS ROYAL ADMINISTRATIONS WILL OPERATE WITH JOINT ADMINISTRATIVE COLLABORATIONS OF HIS ROYAL ADMINISTRATIONS BASED IN IRELAND AND UK ALONG WITH SUPPORT OF HIS ROYAL FAMILY MEMBERS / RELATIVES FROM BRITISH ROYAL FAMILY TOGETHER .

WEBLINK : https://www.theworldleadersforum.international/post/about~-federation-govt-of-commonwealth ;

*TAX AND TRADE MATTERS UNDER BRITISH EMPIRE & HISTORICAL MORE INFORMATION OF DIFFEERNT REGIONS WITHIN BRITISH EMPIRE UNDER ABSOLUTE MONARCHY :

6) https://www.mountvernon.org/george-washington/colonial-life-today/early-american-economics-facts/ ;

22) https://www.theguardian.com/commentisfree/2022/sep/13/royals-commonwealth-debts-colonies-monarchy ;

26)

QUESTION: Can the Commonwealth / Commonwealth Govt (Monarchy) ~ Tax the States?

ANSWER:

Subject to Section 114 of the Commonwealth Constitution, the Commonwealth may impose taxes upon the States. Section 114 only protects the States from a tax that applies to the ownership or holding of property, rather than one on transactions which affect its property.

Section 114 provides that the Commonwealth cannot tax state property, nor States tax Commonwealth property, without the consent of the other. The entity that is claiming the exemption must actually be a State or the Commonwealth and an entity that is controlled by a State will not be covered.

QUESTION : Who can impose Tax in Australia? ANSWER : The Commonwealth Section 51(ii) of the Australian Constitution grants the Commonwealth the power to impose taxes, and to impose laws regarding the collection and administration of taxes. The Constitution also distributes taxing rights between the Commonwealth and the States.2

*GENERAL DIGITAL INFORMATION SOURCES ON THE BRITISH EMPIRE :

*CURRENT EMPOWERED HIGH OFFICIALS FOR THIS PARTICULAR SOVEREIGN ROYAL ADMINISTRATION OF BRITISH ISLES & BRITISH EMPIRE :

1) CHIEF ROYAL ADMINISTRATOR

~ H.E. PROF. DR. MAHENDRA B JAIN ;

2) SOVEREIGN MILITARY GENERAL & CHIEF OF ROYAL ARMED FORCES

~ NEW TERM OF THE GENERAL ROBERT BIAZON EXTENSION WILL TAKE PLACE AFTER OFFICIAL NEW MOU / BILATERAL AGREEMENT WITH IPC PHILCOM IN 2025.

*DIFFERENT TYPES OF LAWS THAT PROTECTS THE LEGAL RIGHTS OF THE SOVEREIGN EMPEROR (KING OF KINGS) & HIS MONARCHY & SOVEREIGN ROYAL HOUSES WORLDWIDE IN ALL CONTINENTS :

*TWLF IGO GOVERNOR GENERAL (KING OF KINGS / THE EMPEROR) HAS BEEN MEANWHILE OFFICIALLY RECOGNIZED AS THE MOST EDUCATED PERSON ON EARTH :

*ADDITIONAL SPIRITUAL CROWN DESIGNS OF THE ~ KING OF KINGS

(THE EMPEROR) :

*DIFFERENT ROYAL ADMINISTRATIONS OF ~ KING OF KINGS (THE EMPEROR) BASED IN DIFFERENT REGIONS :

*OUR COPYRIGHT RECORD OF ~ '' BRITISH EMPIRE & BRITISH ISLES '' :

....................................................................................................................................................................................................................................................................................................................

*Emperor William I, commonly known as William the Conqueror, was the first Norman King of England after his successful invasion in 1066. His reign and that of his successors saw significant developments in currency, particularly as a result of the Norman influence on the Anglo-Saxon monetary system. Here’s a brief overview of the currencies used during his time and that of his progeny :

1. Anglo-Saxon Coinage (Before William I)

Type: Silver Penny (Penny)

Era: Pre-1066

Details:

Before William's conquest, the Anglo-Saxon monetary system primarily used silver pennies.

The pennies were often minted in local mints and featured the names and images of the reigning kings.

The currency system was relatively decentralized, with local variations in coinage.

2. Norman Coinage Introduction (Post-Conquest)

Type: Silver Penny

Era: After 1066

Details:

Following his conquest, William I adopted and adapted the existing Anglo-Saxon coinage system.

He introduced a new design for the silver penny, which featured his image and the Latin inscription "Willelmus Rex" (William King).

The Norman pennies were minted in various locations, including London, Winchester, and York.

3. William I’s Reforms and the "Harrying of the North"

Type: Silver Penny

Era: 1070s

Details:

After the rebellion in the North, William's policies included economic measures that stabilized the currency and supported the rebuilding of towns and trade.

The penny remained the standard currency throughout his reign, maintaining its value and importance in trade.

4. Henry I Coinage (William I’s Son)

Type: Silver Penny

Era: 1100–1135 CE

Details:

William I’s son, Henry I, continued to use the silver penny but introduced new designs and improved minting practices.

Henry’s pennies often featured the king’s image on one side and religious symbols or a cross on the reverse.

Henry I also established more centralized control over coin production, leading to more consistent currency quality.

5. Stephen of Blois (William I’s Grandson)

Type: Silver Penny

Era: 1135–1154 CE

Details:

Stephen continued the use of the silver penny but faced significant challenges due to the civil war known as "The Anarchy."

His coins often bore the name "Stephen" and were minted in various regions, reflecting local authority during his troubled reign.

The quality and standardization of coinage varied significantly during this period due to political instability.

6. Plantagenet Currency Reforms (After William I’s Line)

Type: Groat and New Penny

Era: 12th Century

Details:

After the reign of Stephen, the Plantagenet dynasty (beginning with Henry II) introduced new currency forms, including the groat, which was a larger silver coin worth four pennies.

The new penny continued the tradition established by William I, but with further refinements in design and minting.

7. Long Cross Penny (Edward I)

Type: Silver Long Cross Penny

Era: 1279 onwards

Details:

Although this coin was introduced long after William I's reign, it is worth noting as a significant evolution of the penny.

The long cross design introduced by Edward I indicated a move towards a more standardized and regulated currency, a legacy of the earlier reforms set in motion by William I.

*Summary of Key Currency Developments :

Anglo-Saxon Silver Penny: Standard currency before William's reign, locally minted.

Norman Silver Penny: Introduced post-conquest with new designs and inscriptions, marking the start of William I's currency system.

Centralization under Henry I: Improvements in minting practices and consistency in coinage quality.

Stephen's Challenges: Continued use of the silver penny amidst political instability.

Evolution to Groat: Later developments in currency included new denominations like the groat.

*Conclusion :

William I's reign marked a significant transformation in English currency, moving from a decentralized Anglo-Saxon system to a more standardized and controlled monetary system. His successors continued to build on this foundation, leading to more refined and varied forms of currency in England.

....................................................................................................................................................................................................................................................................................................................

*The British Empire, at its height, spanned across various continents and governed numerous territories, each often having its own currency systems.

Over time, the British Empire approved or launched different currencies to

cater to its global economic needs. Here is a brief overview of some key currencies used across the British Empire :

1. Pound Sterling (GBP)

Introduced: Circa 8th century, standardized in 1694 with the establishment of the Bank of England.

Usage: The primary currency of the United Kingdom and the standard currency of the British Empire.

International Influence: During the height of the empire, the pound sterling became a key global reserve currency and was widely accepted across colonies.

2. Indian Rupee

Introduced: Officially adopted by the British East India Company in 1835 and formalized as the currency of British India (including present-day India, Pakistan, and Bangladesh).

Usage: Used throughout British India and regions under its influence, including Aden, Burma, and parts of East Africa.

Special Features: The Indian Rupee was initially based on silver, making it distinct from the gold-backed British pound.

3. Australian Pound

Introduced: 1825, with the British pound introduced to Australia as its official currency.

Usage: Used in the colonies of Australia until 1966, when it was replaced by the Australian Dollar (AUD).

Special Features: It was pegged to the pound sterling but featured local designs.

4. Canadian Pound and Canadian Dollar

Canadian Pound: Introduced in 1825 as the official currency for British North America (Canada).

Canadian Dollar: Adopted in 1858, replacing the Canadian pound and aligning more with the U.S. dollar for ease of trade.

Usage: Throughout British Canada and its territories.

5. Straits Dollar

Introduced: 1903, to replace the Indian Rupee in British-controlled Malaya, Singapore, and British Borneo.

Usage: Widely used in British Malaya, Singapore, Brunei, and Borneo.

Special Features: The Straits dollar helped standardize the currency system across British Southeast Asia.

6. British West African Pound

Introduced: 1912, for use in British West African colonies, including Nigeria, Ghana (then the Gold Coast), Sierra Leone, and Gambia.

Usage: This currency served as a unified currency for West African British colonies until these countries gained independence.

Special Features: Pegged to the pound sterling but specifically minted for West African colonies.

7. East African Shilling

Introduced: 1921, replacing the Indian Rupee in British East Africa (Kenya, Uganda, Tanganyika, and Zanzibar).

Usage: Used across British East Africa, and after independence, many nations continued to use variants of the shilling.

8. Falkland Islands Pound

Introduced: 1899 as the official currency of the Falkland Islands.

Usage: Still in use today, pegged at par with the British pound.

9. Rhodesian Pound

Introduced: 1896 for use in Southern Rhodesia (modern-day Zimbabwe) and Northern Rhodesia (now Zambia).

Usage: Used in the Rhodesias and Nyasaland (now Malawi) until replaced by local currencies after independence.

10. British Caribbean Dollar (Eastern Caribbean Dollar)

Introduced: 1935, used in British territories in the Caribbean, such as Trinidad, Barbados, and the Windward and Leeward Islands.

Usage: Formed the basis for the modern Eastern Caribbean Dollar (XCD) used by several Caribbean nations.

11. Hong Kong Dollar

Introduced: 1863 as the official currency of British Hong Kong.

Usage: Still used today, the Hong Kong dollar (HKD) was introduced to replace various forms of currency in use at the time, including the Spanish dollar.

12. Cypriot Pound

Introduced: 1879 in British Cyprus.

Usage: Continued until Cyprus adopted the Euro in 2008.

13. Fijian Pound

Introduced: 1873 in British-controlled Fiji.

Usage: Replaced by the Fijian dollar in 1969.

14. Gibraltar Pound

Introduced: Officially adopted in 1898.

Usage: Still in use today and pegged to the British pound.

15. Mauritian Rupee

Introduced: 1876, replacing the Indian rupee in Mauritius.

Usage: Remains the official currency of Mauritius.

16. New Zealand Pound

Introduced: 1840, when New Zealand became a British colony.

Usage: Replaced by the New Zealand dollar (NZD) in 1967.

*Summary :

Core Currency: Pound Sterling was the backbone of the British Empire's monetary system.

Regional Currencies: In many colonies and territories, local currencies were developed (e.g., Indian Rupee, Straits Dollar) to adapt to local conditions and trade.

Post-Empire Legacy: Several currencies originating in the British Empire remain in use today (e.g., Hong Kong Dollar, Eastern Caribbean Dollar).

These currencies reflect the British Empire's vast global reach and its efforts to standardize and control economic systems across its territories .

....................................................................................................................................................................................................................................................................................................................

*Here’s an A to Z list of notable books that cover the laws and legal systems of the British Empire. This includes works on colonial law, imperial governance, and how the legal systems of the British Empire influenced various colonies and dominions :

*A :

"A Passage to India" – By E.M. Forster (Though a novel, it explores British legal issues in colonial India) ;

"A Legal History of the British Empire" – By Shaunnagh Dorsett and John McLaren (Explores how law was applied across the British Empire) ;

*B :

"British Colonial Law" – By Sir Charles James Tarring (Compilation of colonial laws during British rule) ;

"British Imperialism, 1688–2000" – By P.J. Cain and A.G. Hopkins (Covers the legal and economic frameworks of British imperialism) ;

*C :

"Colonial Lives Across the British Empire" – Edited by David Lambert and Alan Lester (Focus on governance and legal life in colonies) ;

"Constitutional History of England" – By F.W. Maitland (Analysis of British constitutional principles that influenced colonial governance) ;

*D :

"Decolonization and the British Empire, 1775–1997" – By D.K. Fieldhouse (Covers legal transitions as the empire decolonized) ;

"Discipline and Punish: The Birth of the Prison" – By Michel Foucault (Influential for understanding the legal punishment systems in colonial settings) ;

*E :

"Empire and Legal Thought: Ideas and Institutions from Antiquity to Modernity" – By Edward Cavanagh (Covers legal ideas within the context of empire, including the British Empire) ;

"Empire of Law: The Emergence of the Common Law in the Empire" – By Ronald J. Daniels ;

*F :

"Freedom's Battle: The Origins of Humanitarian Intervention" – By Gary Bass (Includes discussions on British imperial interventions and the legal justifications) ;

*G :

"Gandhi and the Empire" – By Judith Brown (Examines British law and its impact on colonial India and the legal struggles for independence) ;

*H :

"History of British India" – By James Mill (Documents the British legal administration in India) ;

"How Britain Rules Africa" – By George Padmore (Insight into colonial governance and the legal systems in Africa) ;

*I :

"Imperial Justice: Africans in Empire's Courts" – By Bonny Ibhawoh (Examines the legal system of British colonies in Africa) ;

"India Conquered: Britain’s Raj and the Chaos of Empire" – By Jon Wilson (Examines the British legal system in colonial India) ;

*J :

"Justice in a Time of Empire" – By Charles Parkinson (Covers legal governance and the impact of British law on colonies) ;

"Judicial Committee of the Privy Council and the British Empire" – By Peter Fraser (Examines the role of this judicial body in overseeing colonial legal matters) ;

*K :

"King Leopold's Ghost" – By Adam Hochschild (Covers the legal framework and abuses in the Congo Free State under British scrutiny) ;

"Kaleidoscopes of Empire: Colonial Courts and the British Imperial Legal Imagination" – By Andrew Arsan (Legal perspectives in colonial courts) ;

*L :

"Law, Liberty, and the British Empire" – By Philip Stern (Examines the legal frameworks of the British Empire) ;

"Laws of the British Colonies in Africa" – By Robert William Lee (Compilation of laws in British African colonies) ;

*M :

"Magna Carta and the English Legal Tradition" – By Ralph V. Turner (How Magna Carta principles were applied in British colonies) ;

"Making Empire: Colonial Encounters and the Creation of Imperial Rule in Nineteenth-Century Africa" – By Richard Price ;

*N :

"Nations and Nationalism since 1780" – By Eric Hobsbawm (Discusses the legal challenges of nationalism within British colonies) ;

"Negotiating the End of the British Empire in Africa, 1957-1965" – By Peter Docking (Examines the legal frameworks during decolonization) ;

*O :

"Of Revelation and Revolution: Christianity, Colonialism, and Consciousness in South Africa" – By John Comaroff and Jean Comaroff (Covers the intersection of British colonial law and religion in South Africa) ;

"Ordinances and Orders of the British Colonies" – By Various Legal Scholars (Compilation of ordinances in British colonies) ;

*P :

"Protectorates and Protectorate Treaties in the British Empire" – By P. Carnegie (Covers the legal aspects of British protectorates) ;

"Piracy and Law in the British Empire" – By Douglas Burgess (Focus on how piracy laws were enforced across British colonies) ;

*R :

"Ruling the World: Freedom, Civilisation, and Liberalism in the Nineteenth-Century British Empire" – By Alan Lester (Legal philosophies underpinning British rule) ;

"Routledge Handbook of the History of Colonialism in Southeast Asia" – By Robert Cribb (Includes legal history of British colonies in Southeast Asia) ;

*S :

"Sir William Jones: A Life in the Law" – By Michael J. Franklin (Legal influence of Sir William Jones in India) ;

"Sovereignty and the Law: Domestic, European and International Perspectives" – By Richard Rawlings (Covers imperial sovereignty and British legal influence) ;

*T :

"The British Empire and the Origins of International Law" – Edited by Martti Koskenniemi (Explores the empire's role in shaping international law) ;

"The Rule of Law in the British Empire" – By Brian Simpson (Analysis of how British legal principles were exported) ;

*U :

"Unfinished Empire: The Global Expansion of Britain" – By John Darwin (Examines legal and governance systems across the empire) ;

"Upholding Empire: The Judicial Committee of the Privy Council and the British Empire" – By W. Wesley Pue ;

*V :

"Victorian Empire and Colonial Law" – By Hamar Foster and John McLaren (Covers the intersection of British law and the Victorian empire) ;

"Violence and Colonial Order: Police, Workers and Protest in the European Colonial Empires" – By Martin Thomas (Explores law enforcement in British colonies) ;

*W :

"Welfare and the State in British Colonial Africa" – By Helge Kjekshus (Legal foundations of social welfare in British Africa) ;

"White Man's Justice: South African Political Trials in the Black Consciousness Era" – By Duncan Innes (Examines British legal principles in South Africa during apartheid) ;

*Z :

"Zones of Peace in the Third World: South-East Asia and the British Colonial Legacy" – By Arie M. Kacowicz (How British law influenced the post-colonial legal order) ;

This list includes books that cover legal, constitutional, and governance aspects of the British Empire, focusing on its global reach and its legal systems.

*'' Hossain '' ~ Dynasty (Royal Dynasty) And Its Variants Have Deep Historical Records Across Various Regions :

*'' Chowdhury '' ~ Dynasty (Royal Dynasty) And Its Variants Historical Records Info Across Various Regions !!! :

*MILITARY ORDERS THAT ALWAYS EXISTED UNDER ~ ROMAN & BRITISH EMPIRE :

*LIST OF LARGEST EMPIRES :

*DIFFERENT CROWNED IMAGES OF THE SOVEREIGN EMPEROR (KING OF KINGS) HAS BEEN UPDATED :

Comments